We all know that 2020 was a strange year and it did strange things to Kiwi buying patterns – or did it? Well, yes and no.

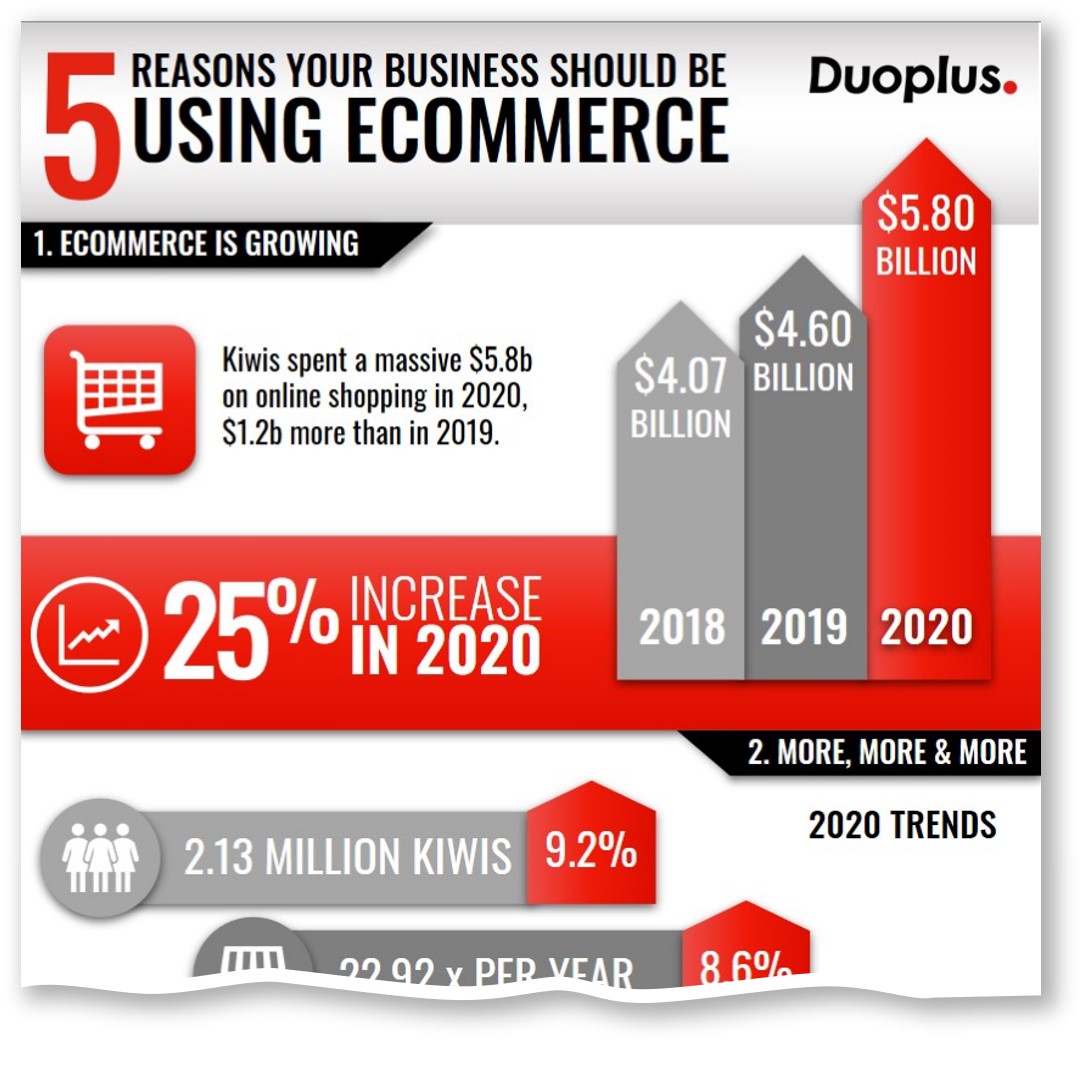

Yes there was a 25% increase in ecommerce, and yes, more people purchased online than ever before.

But no, in many ways this was an increase waiting to happen. NZ is already behind Australia, the UK and US in terms of online spending. I’ll get back to that in a minute.

5.8 Billion Dollars!

According to NZ Post, at its peak in May 2020, online spend hit over $30m a day, resulting in monthly spend 56% higher than the equivalent months, in 2019.

And once shoppers were online, and new habits formed, many remained there, even when the stores reopened. By year end, Kiwis had spent a massive $5.8b on online shopping, $1.2b more than in 2020.

That’s a phenomenal 25% growth.

This is great news for all of our Hamilton and NZ ecommerce success stories!

What makes this interesting is the observation that in recent years store-based sales have been flat. A trend is definitely taking shape and its not subtle.

Data sourced from NZ Post – The Full Download 2021

More, more and more…

What developed during 2020 was a long overdue increase in every online spending metric.

More Kiwis shopped online (2.13m, up 9.2%)

They shopped more often (on average 22.92 times a year, up 8.6%)

They spent more each time ($109.33, up 7%).

NZ Post go on to say that, The average Kiwi shopper spent $2,523 online in 2020 (up 15.6%).

Much of this took place during the Covid-19 lockdown, with many stores closed for at least two months. Despite this, instore spending in 2020 was up well over a billion dollars (up 3%) on 2019, and overall retail spending was $53.1b, up 5% on the year before.

The obvious conclusion is that not as many people were going to Bali during that time, and so they had more discretionary money than usual to spend..

The good news is that both online and physical stores benefited from a ‘buy local’ sentiment, with over 71% of all spend in 2020 with local retailers.

Shoppers vs non-shoppers 2020 (Source: NZ Post)

Playing catch up

In recent years, online spending continues to grow as a proportion of total sales. Compared to Australia though, NZ is almost standing still. Online spending grew a whopping 57% in Australia, with over nine million households purchasing online in 2020 – 4 out of every 5 households!

Australian online spending is a whopping $50.4 billion – almost 10 times that of New Zealand.

“…online in Australia now makes up 16% of all spending, compared to New Zealand’s 11%.”

“…in the UK and US, online penetration is well over 20%”

All this to say that, if you’re worried that 2020 NZ growth was an anomaly, the trends overseas suggest differently. NZ is well behind our main trading partners overseas and there is still room for improvement.

Now that Kiwis have experienced such success ecommerce, we should expect to see it increase.

In fact, our end-of-year spend was almost as significant as the lockdown spending, suggesting that we found it was much easier to buy Christmas prezzies this way!

Weekly online spend 2019 vs 2020 (Source: NZ Post)

What you need to know about WHO is buying

There was significant growth across the board as far as age goes. However, the older aged group had the most remarkable increase.

They grew in outright number of shoppers, shopped more often than ever before, and spent more as well.

“Shoppers aged over 60 make up 22.6% of all online shoppers with about half of all 60-74 year olds, and a third of the 75+ age group, now online.

On average, the 60+ group made one to two transactions a month, spending well over $1,900 per annum for each person online.”

But if you want to know which age groups spends the most, its the 45-59 group. Their average annual spend is a whopping $3,110.

Not far behind them is the 30-59 year old group who dominate online shopping with nearly 70% of all online spending. They also spend most frequently, averaging more than 28 times each annually

The Gender Gap

Incidentally, women make up 54% of online shoppers. However men make the most one-off purchases of large items.

Which sectors won?

- As expected, Food, Groceries & Liquor saw massive growth – with spend up 47% – as lockdowns helped Kiwis embrace online shopping and contactless delivery. But this wasn’t the year’s biggest winner.

- Homeware, Appliances & Electronics experienced the highest growth in 2020. Spend was up a massive 49%.

- Department & Variety continues to be our biggest online sector at 30% of all online spend, down slightly from previous years.

Interestingly, Taranaki experienced the fastest rate of growth, with 46% increase in online spending.

Total online spend by sector (Source: NZ Post)

More Kiwis are on board than ever before

NZ Post observed that there were over three-hundred thousand Kiwis who shopped online for the first time in 2020. Well more than half were 45 years old or more. They didn’t shop as often as other shoppers, but when they did they spent considerably more.

This brings NZ to a new benchmark. More than half of adult kiwis are now buying online on a regular or semi-regular basis.

Domestic vs International

The good news is that they are spending domestically rather than internationally.

When kiwis do buy internationally, 57% of kiwis buy from Australia. The makes Australia the most popular country for Kiwis to buy from, overtaking China which remains on 50%. These two countries account for a third-each of all international purchases.

Interestingly, the online growth in Australia has seen a growing number of Aussies buying from retailers on our side of the ditch!

2020 sector online spend domestic vs international (Source: NZ Post)

What do we make of all this?

It seems clear that the world is changing, and NZ is not immune. There is a far greater willingness to purchase online rather than go into the traditional bricks and mortar stores.

202 was for many people a test case. Consumers got to test whether or not ecommerce would be convenient and effective for them.

Ecommerce providers got to test out their systems and iron out the wrinkles.

What questions do you have?

- Do you already have an ecommerce site and would like to develop it more?

- Are you happy with the results you are getting? Or do you suspect there is room for improvement?

- Are you ready for your ecommerce adventure but don’t know how to start?

- Do you know what questions you should ask your online marketing agency?

If you would like to discuss ecommerce within the context of your business, please contact us for a free consultation.

You can download the NZ Post Full Download 2021 report here.

This blog was originally published on the Duoplus Ecommerce Blog